Elsa Jones Blog

-

Making mileage payments to employees

Making mileage payments to employees

As the country emerges from the Covid-19 pandemic, business travel is once again on the agenda. Where employees undertake business travel,…

-

Do I need to register for VAT?

Do I need to register for VAT?

You must register your business for VAT if your VAT taxable turnover exceeds the registration threshold. This is currently £85,000. You…

-

Tax relief on loans to close companies

Tax relief on loans to close companies

Family and personal companies are often ‘close’ companies. Broadly, this is one that is controlled by five or fewer shareholders or…

-

Termination payments and Class 1A National Insurance

Termination payments and Class 1A National Insurance

As the Coronavirus Job Retention Scheme comes to an end, employers with employees who are still on furlough will need to…

-

Claim tax relief for additional costs of working from home

Claim tax relief for additional costs of working from home

During the Covid-19 pandemic, the advice was ‘work from home if you can’. As a result, millions of employees found themselves…

-

Take dividends while you can

Take dividends while you can

For personal and family companies, a tax efficient strategy for extracting profits is to take a small salary and to extract…

-

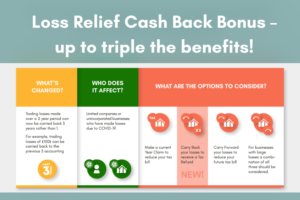

COVID Losses Cash Back Bonus – up to triple the benefits!

COVID Losses Cash Back Bonus – up to triple the benefits!

Due to the impact of COVID-19, the government want to give businesses who have suddenly suffered significant losses, an opportunity to…

-

Expenses and benefit returns for 2020/21

Expenses and benefit returns for 2020/21

Expenses and benefits returns P11D and P11D(b) for 2020/21 need to be filed by 6 July 2021. Meeting this deadline is…

-

NIC and company directors

NIC and company directors

Special rules apply to company directors when it comes to calculating their Class 1 National Insurance liabilities. Why the rules Directors,…

-

No retained profits – Can you extract cash to cover your living expenses?

No retained profits – Can you extract cash to cover your living expenses?

If you operate through a limited company, for example as a personal or family company, you will need to extract funds…

-

Reduced rate of VAT

Reduced rate of VAT

To help the hospitality and leisure industry recover from the impact of the first national lockdown, a reduced rate of VAT…

-

Reporting expenses and benefits for 2020/21

Reporting expenses and benefits for 2020/21

Employers who provided taxable expenses and benefits to employees during the 2020/21 tax year will need to report these to HMRC,…